tax benefit rule quizlet

Define the term constructive receipt. Identify the rule that determines whether a taxpayer must include in income a refund of an amount deducted in a previous year.

Chapter 6 Retirement Plans Flashcards Quizlet

For example you provide an employee with a fringe benefit when you allow the employee to use a business vehicle to.

. Dave is taxed on 62000 of plumbing income this year. Legal Definition of tax benefit rule. 2 Taxpayer realizes income.

Steve is taxed on 62000 of plumbing income this year. If an amount deducted as an itemized deduction in one year is refunded in a subsequent year it must be included in gross income in. However in recent years the Internal Revenue Service IRS has renewed its focus on enforcement of the private.

Taxpayers recognize income when what three things are met. Statement 3 - As a rule taxes. The tax benefit rule is intended to ensure that companies do not write off debt with the intention of collecting it later.

Benefits Received Rule. The important question is whether the taxpayer receives economic benefit. Intermediate sanctions legislation was passed in 1996.

Example of the Tax Benefit Rule. Tax benefit rule quizlet Thursday March 24 2022 Edit. A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the government.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross. Tax refund rule B. Jones recovers a 1000 loss that he had written off in his previous years tax.

Lets say you receive a 1000 refund from Iowa when you filed your 2016 tax return in 2017. Under the so-called tax benefit rule a taxpayer need not include in his gross income and therefore need not pay tax on it amounts recovered for his loss if he did not. The benefit principle is utilized most successfully in the financing of roads and highways through levies on motor fuels and road-user fees tolls.

The rule is promulgated by the Internal Revenue Service. 3 No tax provision allows the taxpayer to exclude or. Lets look at state tax refunds as an example.

Tax benefit rule quizlet Wednesday March 9 2022 Edit. IRC 111 111a TBR Alice Phelan Sullivan Corporation v. A fringe benefit is a form of pay for the performance of services.

A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included. United States and more. 1 Taxpayer receives an economic benefit.

Legal Definition of tax benefit rule. Study with Quizlet and memorize flashcards containing terms like -TBR Code. This refund may or may not be taxable.

Statement 2 - Eminent domain is inferior to non-impairment clause of the constitution. Payroll taxes used to finance social security. The tax law includes a complex set of restrictions called the anti-frontloading rules to make it difficult for taxpayers to disguise and reclassify property payments as alimony payments.

A tax provision that says. Under the concept of constructive receipt income. Steve is taxed on 62000 of income from gifts received this.

Econ 101 Vocab Flashcards Quizlet

Chap 2 Gross Income Exclusions Flashcards Quizlet

Accy 405 Tax Chapter 5 8 Flashcards Quizlet

R2 M2 Itemized Deductions Flashcards Quizlet

Property Regulation Of Business Flashcards Quizlet

R2 M3 Tax Computation And Credits Flashcards Quizlet

Acct 4400 Salt 2 Apportionment Multijurisdictional Tax Issues Uses Of Local State Taxes Acct 570 Ch 12 State Local Taxes 4400 Multi Jurisdictional Tax State And Local Taxation Tax Law Test

R2 M4 Amt And Other Taxes Flashcards Quizlet

61 Gross Income General Concepts And Interest Flashcards Quizlet

Chapter 2 C Corporations Flashcards Quizlet

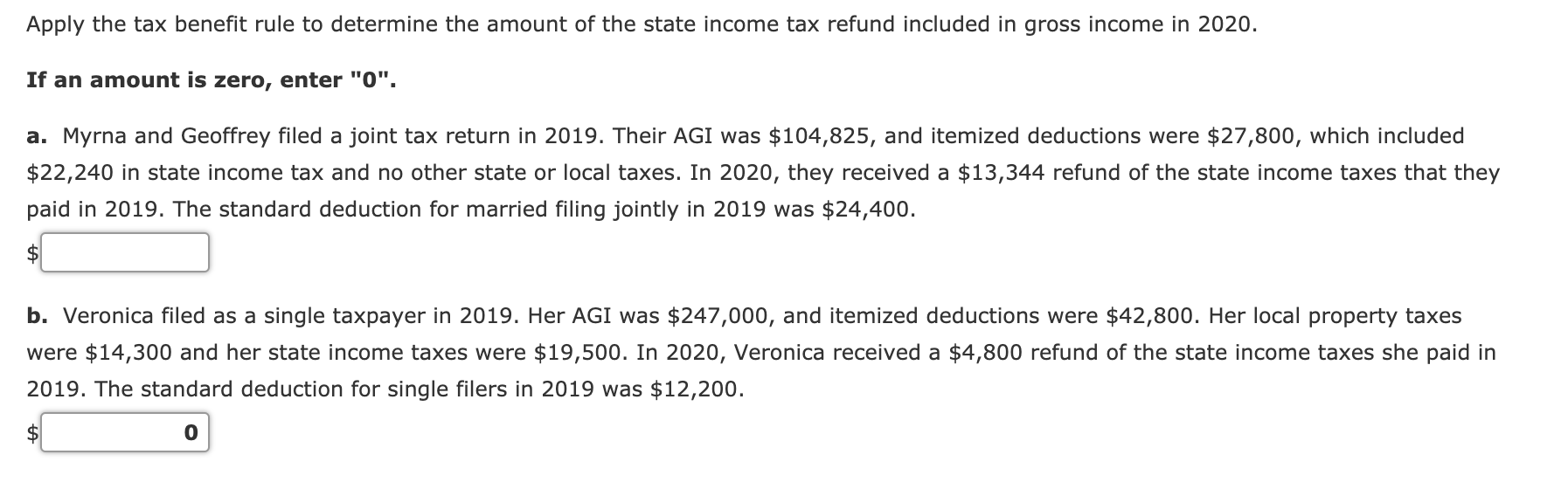

Solved Apply The Tax Benefit Rule To Determine The Amount Of Chegg Com

Ch15 The Deduction For Qualified Business Income For Noncorporate Taxpayers Flashcards Quizlet

Acnt 1331 Chapter 2 Flashcards Quizlet

Hs326 Chapter 10 Employee Benefits Flashcards Quizlet

Acct 3220 Taxation Midterm Ch2 Flashcards Quizlet

Tax Planning Flashcards Quizlet

Ch3 Computing The Tax Flashcards Quizlet

Chap 2 Gross Income Exclusions Flashcards Quizlet

Wgu D080 Managing In A Global Business Environment Diagram Quizlet