opening work in process inventory formula

As a result of this you would have to freeze the production. Determine the cost of goods sold COGS using your previous accounting periods records.

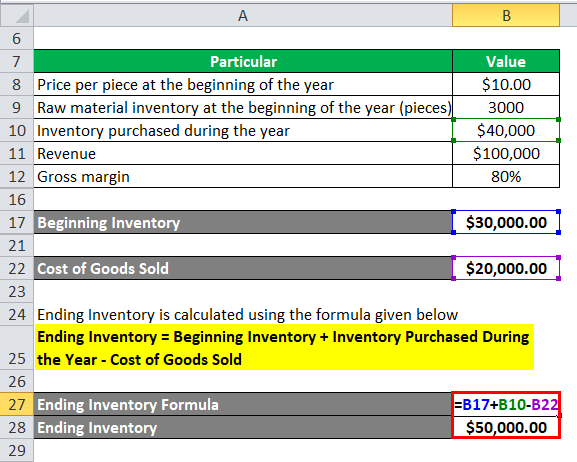

Ending Inventory Formula Calculator Excel Template

Ending WIP Beginning WIP Materials in Direct Labor Overheads -.

. Work in process inventory examples. Lets break down the steps for how to find beginning inventory. Your manufacturer also produced 5000 pairs of shoes each costing.

The formula for calculating beginning inventory is. Higher sales and thus higher cost of goods sold leads to draining the inventory. The work-in-process inventory account is an asset account that is used to track the cost of the partially finished goods.

4325 - Monitor and optimize production process 19566 - Integrating different resources in the production process. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed. The standard work in process inventory definition is all the raw material overhead costs and labor associated with every stage of the production process.

Amount of Goods in Stock x Unit Price Ending Inventory. Once the manufacturer starts the production process those items. That makes it a part of manufacturing inventory see.

Ending Inventory Beginning Balance Purchases Cost of Goods Sold. Work in process inventory formula. 8000 240000 238000 10000.

Deduct the cost of raw material from this figure that is on hand at the end of the accounting period to determine the costs of materials consumed during the accounting. A work in process or WIP for short is the term that refers to any inventory thats been initiated into production but hasnt been completed by the end of a companys accounting cycle. The work-in-process inventory that a company has started but not completed has specific value.

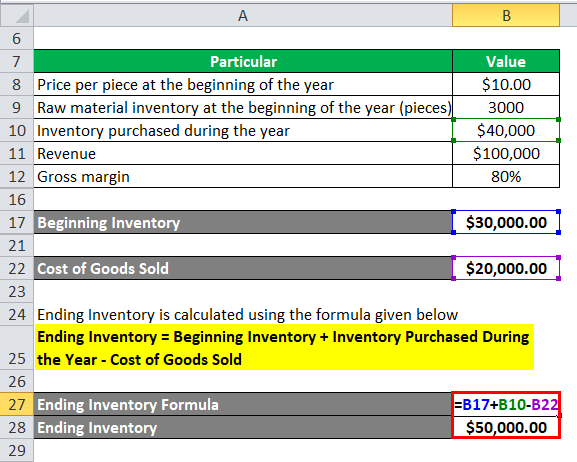

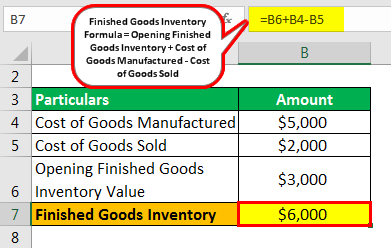

The opening balance in the Process Work-in-Progress a. Opening work-in-process inventory closing work-in-process inventory cost of goods manufactured. Work-in-process is an asset and so is aggregated into the inventory line item on the balance sheet usually being the smallest of the three main inventory accounts of which.

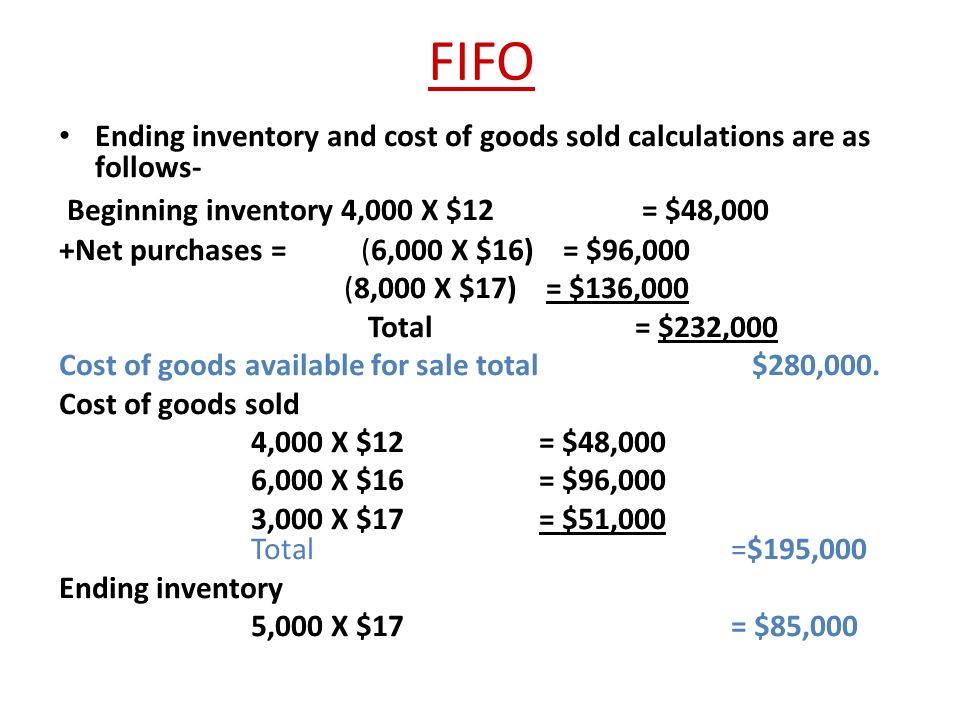

Beginning Inventory Formula COGS Ending Inventory Purchases. FIFO method assumes that those units which represent work-in-progress at the beginning are completed first and the. In the new year you spend 150000 on manufacturing costs.

For a more comprehensive example lets say you run a shoe brand with a beginning WIP of 100000. 24000. How to calculate beginning inventory.

WIPs are considered to be a current. Cost of Goods manufactured Direct materials cost Direct labor cost Factory overhead. The work in process inventory refers to the part of the production cycle of turning your individual raw materials into a kettle.

This results in a simple calculation to find opening inventory. A work-in-progress WIP is the cost of unfinished goods in the manufacturing process including labor raw materials and overhead. This beginning inventory equation or opening stock formula is.

Ending inventory Previous accounting period beginning inventory Net. Next you should add up the calculated ending inventory cost and the CoGS value. Inventory Formula Example 1.

Any raw material inventory that has been combined with human labor but is not yet finished goods inventory is work in process inventory. WIP inventory example 2. Accounting with Opening and Closing Work-in-Progress-FIFO Method.

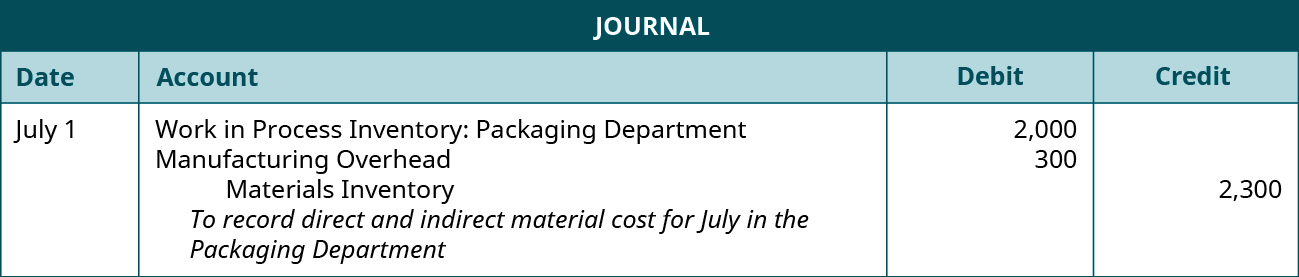

Let say company A has an opening inventory balance of 50000 for the month of July. In accounting a work in progress WIP account is an inventory account that includes goods that are in the process of being produced but are not yet finished. The work-in-process inventory account includes the.

This product value is important for financial reporting. 1200 x 20 24000. Every dollar invested in unsold inventory.

Material personnel equipment robotics etc. The ending work in process is now calculated using the work in process inventory formula as follows. The formula for this is as follows.

So your ending work in process inventory is 10000. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity. For example you have run out of materials to create a certain amount of products.

During the remaining financial year the company has made purchases. Opening Inventory Formula.

How To Calculate Finished Goods Inventory

Inventory Formula Inventory Calculator Excel Template

What Is Work In Process Wip Inventory How To Calculate It Ware2go

3 Types Of Inventory Raw Materials Wip And Finished Goods Youtube

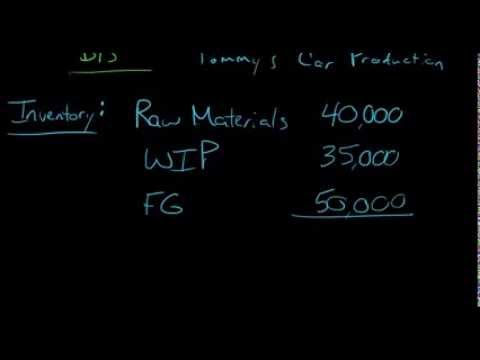

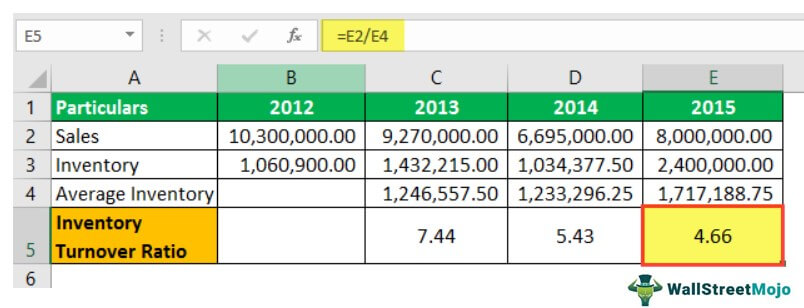

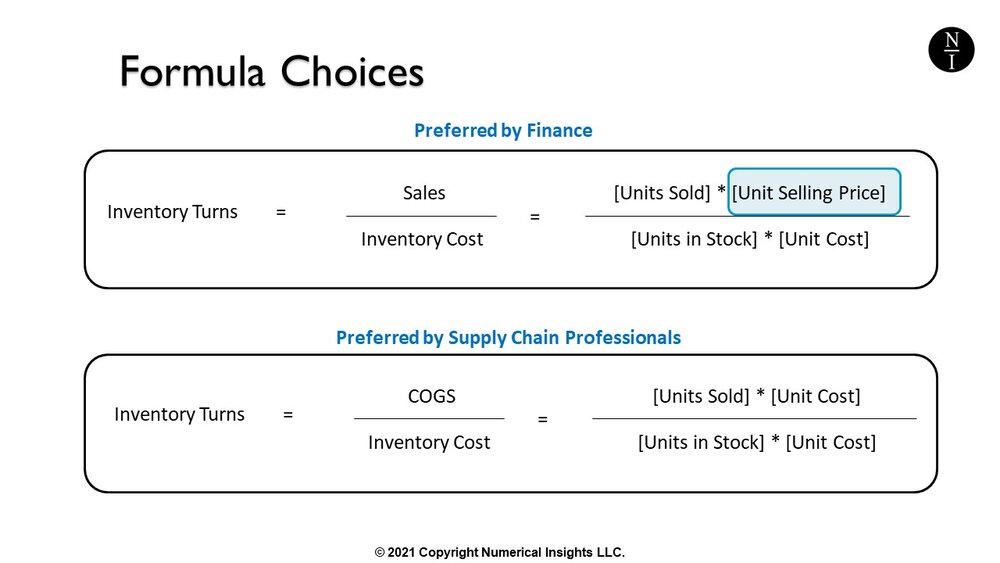

Inventory Ratio Definition Formula Step By Step Calculation

Cost Of Goods Manufactured Formula Examples With Excel Template

How To Calculate Ending Inventory Using Absorption Costing Online Accounting

Finished Goods Inventory How To Calculate Finished Goods Inventory

Ending Work In Process Double Entry Bookkeeping

Work In Process Wip Inventory Youtube

Finished Goods Inventory How To Calculate Finished Goods Inventory

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Formula To Calculate Inventory Turns Inventory Turnover Rate

Wip Inventory Definition Examples Of Work In Progress Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Manufacturing Account Format Double Entry Bookkeeping

Prepare Journal Entries For A Process Costing System Principles Of Accounting Volume 2 Managerial Accounting